Recently the government of India has issued a guideline advising citizens to link their PAN card with Aadhaar card. This is a mandatory process that everyone is bound to follow. The linking process is important because it will allow the income tax return to be processed.

Also if a bank transaction for Rs.50,000 and above is done, linking your PAN with your Aadhaar is necessary in that case. And also note that if you don’t link both within the deadline, you will attract a penalty. So if you are looking to link your aadhaar card with your PAN card, then follow the steps given below

The last date to link PAN card with Aadhaar card has been extended by the Government

According to the Central Board of Direct Taxes (CBDT), if an individual fails to link the two, their PAN cards will be terminated. As a result, no further financial transactions can be done.

The last date to associate Aadhaar with Permanent Account Number (PAN) has been extended by the government to 31 March 2023. Previously, the deadline was March 31, 2022.

However, if an individual fails to link their PAN with Aadhaar by 31 March 2022, he or she will be fined. If PAN and Aadhaar are linked between 1 April 2022 and 30 June 2022, the fine will be Rs. Rs. 1,000.

What is the importance of linking them both?

Both PAN cards and Aadhaar cards are unique ID cards for every Indian citizen that serve as proof of identity and are required for registration and verification purposes.

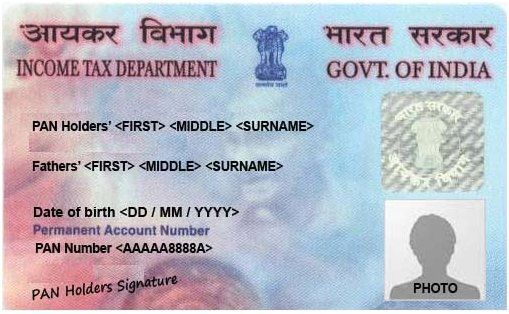

What is a PAN card?

A Permanent Account Number (PAN) is a unique 10-character alphanumeric identifier allotted by the Income Tax Department of India to taxpayers. It is issued in the form of a laminated card. The PAN is mandatory for certain financial transactions such as opening a bank account, obtaining a credit card, filing tax returns, etc.

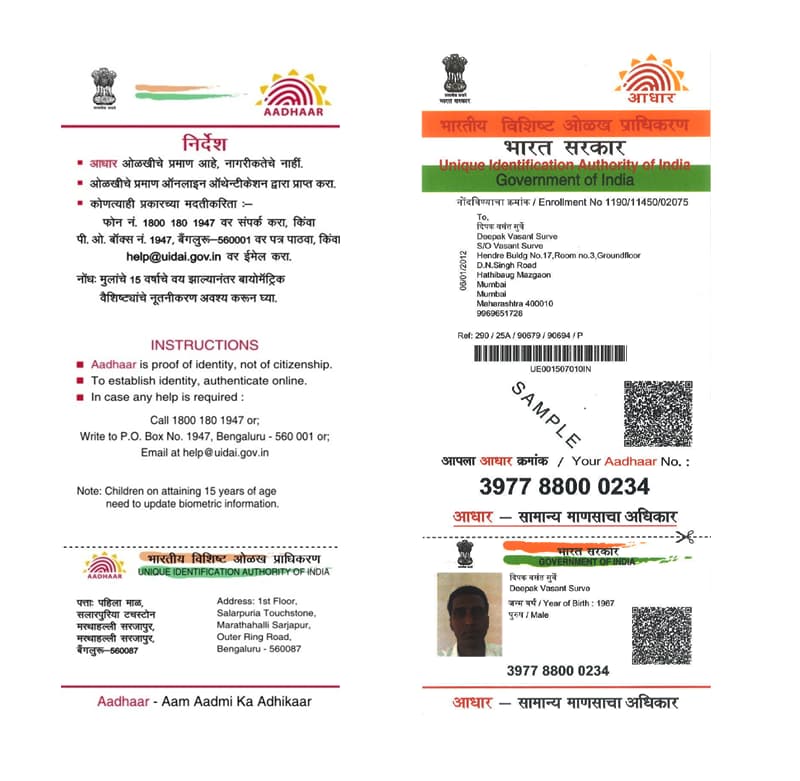

What is an Aadhaar card?

An Aadhaar card is an identification card that is issued to all Indian residents, based on their biometric and demographic data. The card also serves as proof of address and citizenship.

The government has asked all establishments to link their PAN card to their Aadhaar card. This is done for the below-mentioned purposes:

Prevention of tax evasion

By linking the Aadhaar card with the PAN card, governments will be able to monitor the taxable transactions of specific individuals or entities whose identity and address have been confirmed by the Aadhaar card. This effectively means that any taxable transaction or activity is recorded by the government.

As a result, tax payments can’t be evaded or escaped by anyone, with governments already having detailed records of every financial transaction that could tax any business.

Prevents Multiple PAN card of an individual

It is often seen in many cases that certain individuals or entities applying for multiple pan cards to escape tax payment by deceiving the government.

By applying for multiple PAN cards, businesses can use one of the cards for a specific set of financial transactions and pay applicable taxes. On the other hand, another PAN card can be used for accounts and transactions that companies want to avoid paying taxes and hide from the income tax department

By linking the PAN to the Aadhaar card, the government will be able to trace the identity of the entity through the Aadhaar card and receive details of all financial transactions made through the linked PAN card. If multiple PAN cards are registered with the same name, the government can identify the same one and take necessary action against it.

Here are the ways to link Aadhaar card with PAN card

You can link the aadhar card with your PAN card by following these simple steps

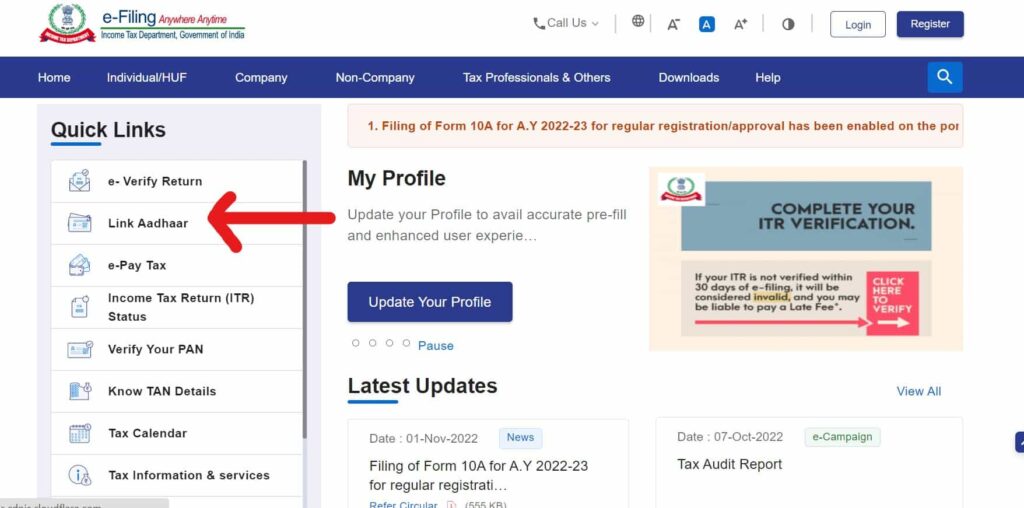

Through e-filing website

- Go to the Income Tax e-Filing website and click on the ‘Link Aadhaar‘ option under Quick Links.

- Enter your PAN and Aadhaar card number

- Please enter the name as it appears on your Aadhaar card

- The box must be ticked if the date of birth is already mentioned on the Aadhaar card

- Tick ​​I agree to verify Aadhaar details with UIDAI.

- Click on the link Aadhaar button.

- Then enter the OTP you receive with your mobile number and click Verify.

- A pop-up message will appear confirming that Aadhaar and the PAN card have been successfully linked.

By sending an SMS

- Open the Message Box on your phone

- Now go to messages and type a message in the format UIDPAN<12 Digit Aadhaar> <10 Digit PAN>

- Send the message in the mentioned format to either 567678 or 56161 from your registered mobile number.

- For instance, let’s say the Aadhaar number is 987654321012 and the PAN is ABCDE1234F, you have to type UIDPAN 987654321012 ABCDE1234F and send the message to either 567678 or 56161

Linking PAN and Aadhaar cards will only and only succeed if all the details match these documents. For errors such as spelling mistakes, PAN will not be associated with Aadhaar.

Note: You can visit your local Aadhaar Enrollment Center or make changes through the NSDL PAN portal.

If the name on your pan card is spelled wrong, follow this process

- You can correct/change your PAN details via the NSDL website.

- Clicking the above NSDL link will take you to a page where you can request a name correction.

- Submit a signed digital document to update your PAN details.

- You can also do an Aadhaar-based e-KYC or submit documents physically at your nearby store.

- Once the PAN details have been corrected and verified by the NSDL via email, the PAN can be linked to Aadhaar.

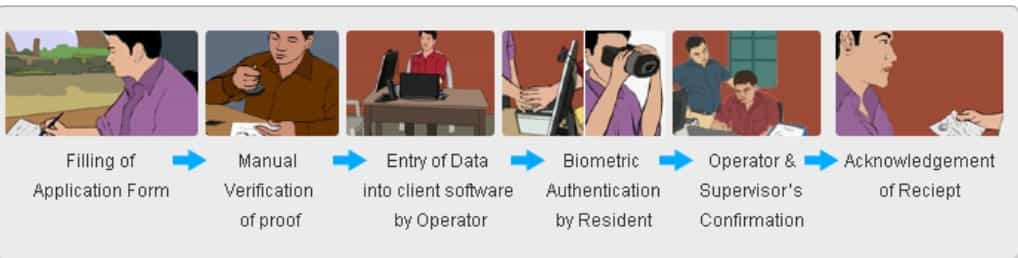

If your name on aadhaar is spelled wrong, do follow this process

(Offline process)

- Visit the Aadhaar Enrollment Center

- Carry a certified copy of your ID details

- Complete the Aadhaar Correction Form

- Submit the form with your documents

- You will receive a confirmation letter with your renewal request number

- You can use this URN (Update Request Number) to check the status of your update request

- Once your renewal request has been processed and your name has been corrected, you can link your PAN to your Aadhaar.

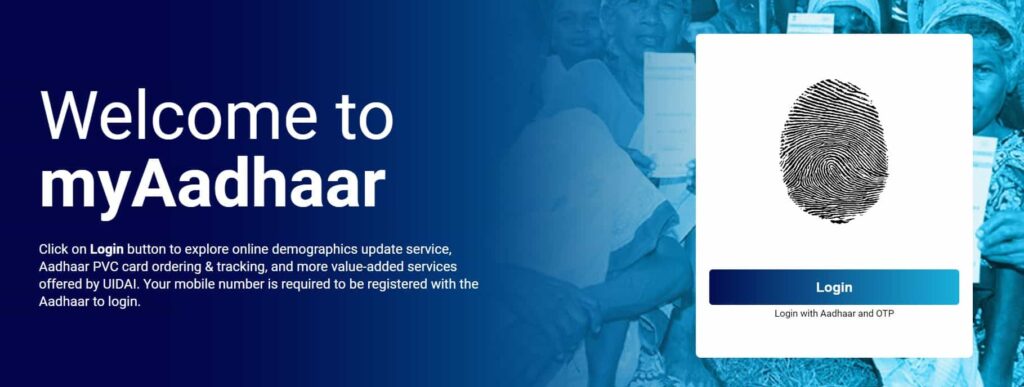

(Online process)

- Visit the UIDAI official website (https://ssup.uidai.gov.in/web/guest/update).

- Enter your 12 digit Aadhaar number and captcha code to log into your account

- Select an OTP option.

- A one-time password (OTP) will be sent to your registration number

- Enter the OTP and tap on the Submit button.

- Select the fields of the Aadhaar card that need to be updated

- Have a scanned copy of your receipt ready as it will need to be uploaded

- After completing the above steps, a URN (Update Request Number) will be generated. This is required for further processes

- Once the Aadhaar card has been updated with new information, print it out.

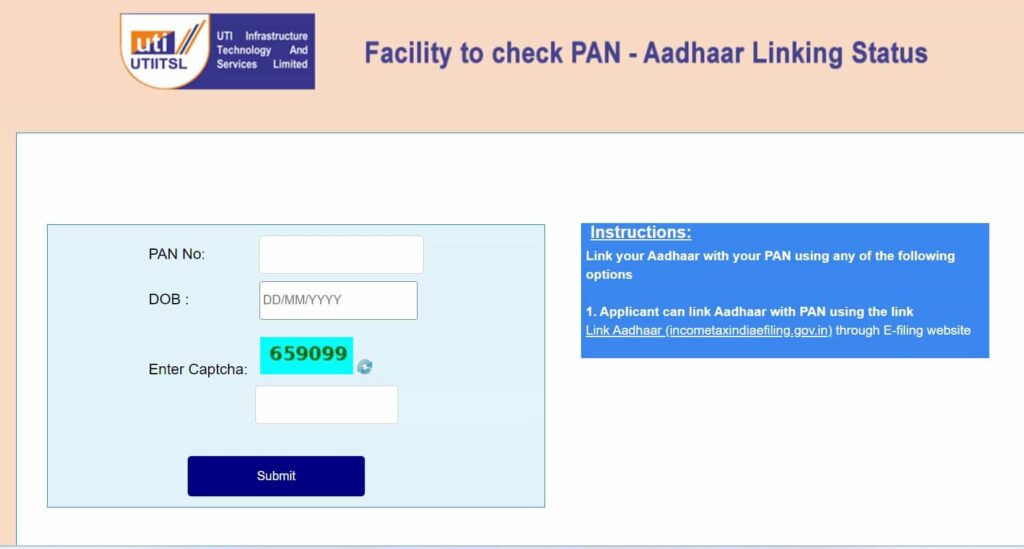

How to track the Aadhaar Card and PAN Card linking Status

- Visit the e-Filing Income Tax Department page

- Find and select “Link Aadhaar Status” under “Quick Links“.

- Enter your PAN number and Aadhaar number

- Click the “View Link Aadhaar Status†icon.

- The aadhaar PAN link status will be displayed on the screen

What if any individual doesn’t link the aadhaar to the PAN card

- TDS deduction will be higher

- Booking a Fixed Deposit above Rs. 50,000 can’t be done.

- You can’t invest or redeem Mutual Funds.

- Cash deposits above Rs. 50,000 can’t be done

- New Debit/Credit Card can’t be applied

- Purchase of any foreign currency beyond Rs. 50,000 can’t be done.

What are the benefits of Linking the aadhaar with PAN card?

You will get many benefits when you link your PAN card with your Aadhaar card. These include-

- It greatly eases the filing of an income return, as the individual does not have to prove that they have filed an income tax return.

- Linking PAN to Aadhaar helps you keep your own tax summary attached to your Aadhaar for future reference

- This eliminates the possibility of owning multiple PAN cards.

- Linking Aadhaar to PAN will enable the Income Tax Authority to closely detect all forms of tax evasion.

- Linking Aadhaar to PAN can prevent PAN from getting terminated.

Wrapping it up

This was an article on how to link your PAN card with your Aadhar card. You must have got complete information on this topic and also what are its benefits and why it is important to link the two. Similarly, you can also link your Aadhaar card with Voter ID in just 5-10 minutes. Stay updated with our blog to get regular updates like this

Frequently asked questions(FAQs)

How do I change the mobile number registered with my Aadhaar?

The UIDAI Help Desk can be reached by emailing [email protected] or by calling toll-free 1800-300-1947.

Do NRIs residing in India also need to link a PAN?

The requirement to cite Aadhaar to file income tax returns and apply for PAN quota effective from 1st July 2017, does not apply to Non-Resident Indians [NRIs].

When is the last date to link PAN to Aadhaar?

PAN must be linked to an Aadhaar by 31st March 2023.